Prorex Account Types DECODED: The Forbidden Chart They Hoped You’d Never See.

In today’s market, your entry into prorex online trading shouldn’t be based on outdated methods; it should be a calculated, tech-forward decision. The first step in this process is interfacing with the right architecture, which begins with selecting a Prorex trading account. Think of this not just as opening an account, but as choosing your operating system for the financial markets. The right system optimizes your workflow, minimizes latency, and provides the data streams necessary for intelligent decision-making. Your initial choice sets the parameters for your entire trading experience, making it the most critical variable in your success algorithm.

Content

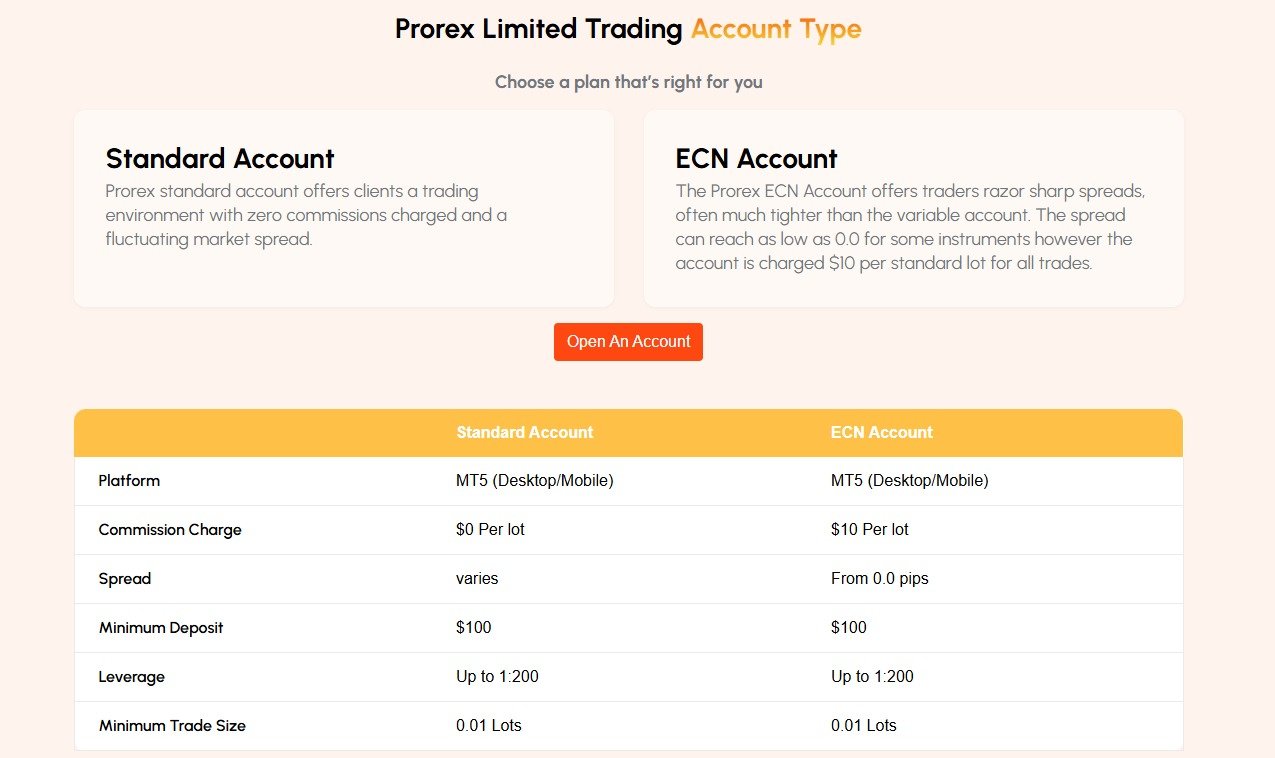

System Architecture: A Prorex Trading Account Types Comparison

To optimize your strategy, a detailed Prorex trading account types comparison is essential. The architecture of each prorex account is engineered for different processing loads. For instance, for beginners often features a streamlined interface with integrated cost structures—think of it as an OS with automated resource management, where Prorex trading fees are bundled into the spread for maximum efficiency. For high-frequency strategies, like those used it for day trading, you’d look at an ECN-style account. These offer raw data feeds (tighter spreads) with a transparent, fixed commission, a setup preferred by traders who run complex algorithms and require minimal execution latency.

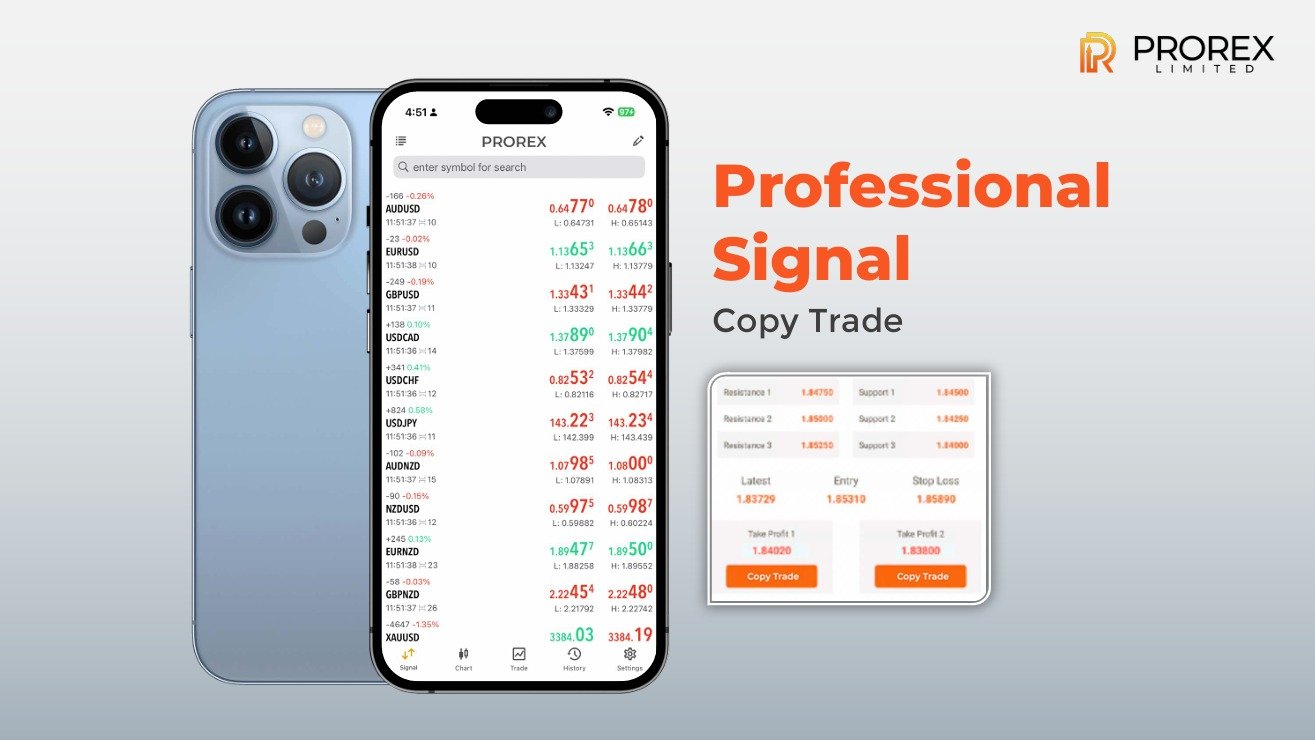

The Command Centre: Interfacing with the Prorex Trading Platform

Your trading account is the engine, but the prorex trading platform is your command interface. In 2025, a platform must be more than just a place to execute trades; it must be a hub of real-time data, advanced analytics, and seamless integration. Look for platforms like MT4 or MT5 that offer robust API support for custom indicators and automated trading bots. The efficiency of your prorex investment hinges on the platform’s stability, execution speed, and its ability to handle complex charting without lag. A technologically superior platform ensures your commands are executed with precision, providing a critical edge in fast-moving markets.

Leverage and Incentives: Calibrating Your Financial Toolkit

Modern brokerage accounts often include sophisticated financial tools, and it’s crucial to understand their technical specifications. The availability of a high leverage Prorex account, for example, is a powerful tool that uses financial engineering to amplify your market exposure. However, it operates with increased risk parameters and must be managed with a disciplined, data-driven approach. Similarly, a prorex trading bonus can be viewed as a form of initial seed capital or a system credit. While beneficial, it’s vital to analyze the terms and conditions—the “protocol” that governs its use—to ensure it aligns with your strategic financial plan before integration.

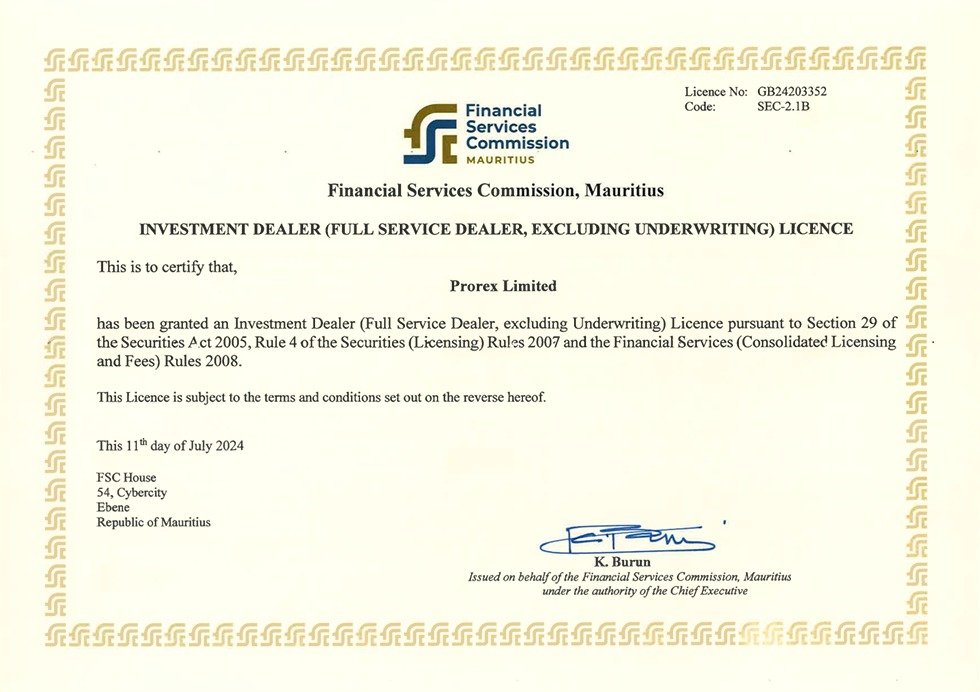

System Verdict: Is Prorex a Good Broker for Beginners from a Tech Perspective?

So, let’s run the final diagnostic: Is Prorex a good broker for beginners who are tech-savvy? The answer lies in the system’s overall user experience and accessibility. A broker fit for a modern beginner should offer a frictionless onboarding process (getting started with Prorex should be seamless), a powerful demo environment that perfectly simulates live market conditions, and access to educational data streams (webinars, tutorials). By assessing the technological infrastructure, from platform stability to the logic of its offerings, you can determine if it provides the innovative and robust framework required to launch your trading journey effectively.

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia